Koperasi Anggota Kerajaan Ipoh Berhad (KAKIB)

Koperasi Anggota Kerajaan Ipoh Berhad (KAKIB) mendapat anugerah Sijil Pematuhan Syariah oleh Biro Angkasa. Jom apply personal loan berlandaskan shariah compliant di sini!

Pengenalan

Koperasi Anggota Kerajaan Ipoh Bhd (KAKIB) ditubuhkan pada 27 Julai, 1923 dan kini beroperasi di 111B, Bangunan Koperasi, Jalan Dato’Onn Jaafar, 30300 Ipoh Perak dengan keanggotaan melebihi 6000 anggota.

Koperasi Anggota Kerajaan Ipoh Berhad KAKIB juga telah menerima pelbagai anugerah termasuk koperasi terbaik dan juga merupakan salah satu koperasi berdaya maju yang tersenarai dalam 100 buah koperasi terbaik di Malaysia. KAKIB di uruskan oleh 15 orang.

Anggota Lembaga yang dipilih melalui Mesyuarat Agung Tahunan. Sejak ditubuhkan , kedudukan keanggotaanadalah melebihi 6000 orang dengan bermodal yuran, syer dan asset yang terkumpul berakhir tahun 2017 sebanyak RM 84.6 juta dengan bermatlamat untuk memantap ekonomi dan sosial.

Gerakan koperasi yang semakin berkembang maju di Negara ini akan menjadi penyumbang utama KDNK.

Selari dengan moto KAKIB sentiasa berikhtiar untuk menyediakan kemudahan dan manfaat yang bersesuaian dengan aspirasi ekonomi Negara.

Setelah hampir melebihi 90 tahun beroperasi, aktiviti Koperasi Anggota Kerajaan Ipoh Berhad KAKIB terus berkembang dengan mencari peluang-peluang untuk menambahkan pendapatan KAKIB.

Keanggotaan

Permohonan

Borang permohonan untuk menjadi anggota KAKIB perlu diisi dengan lengkap dan sempurna beserta dengan salinan penyata gaji bulan terakhir dan salinan kad pengenalan yang telah disahkan oleh pegawai/pengetua beserta nama dan jawatan Yang Diberikan Kuasa.

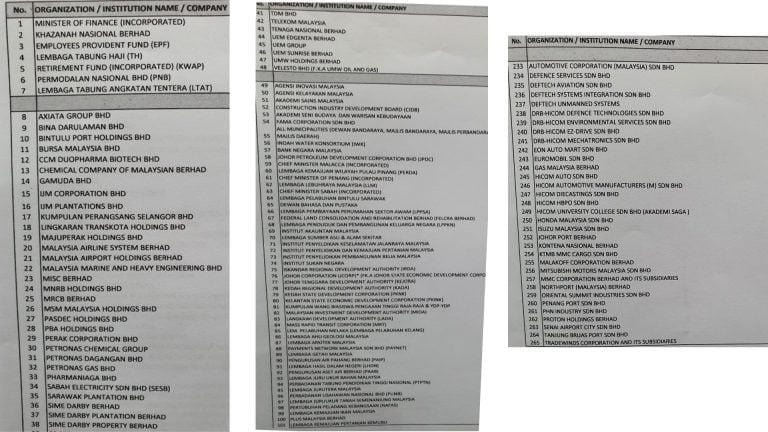

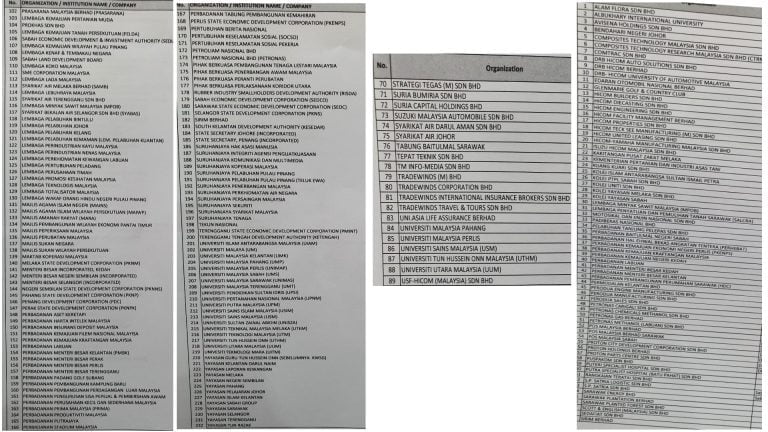

Keanggotaan terbuka kepada kakitangan kerajaan, Agensi Kerajaan, Badan Berkanun atau Pihak Berkuasa Tempatan dimana bayaran potongan bulanan anggota dapat dibuat melalui Biro Perkhidmatan ANGKASA (BPA).

Syarat-Syarat

Syarat-syarat seperti berikut:

- Warganegara Malaysia

- Telah mencapai umur lapan belas tahun

- Bermastautin atau bekerja atau mempunyai hartatanah atau bekerja dalam Negeri Perak

- Bukan seorang yang tidak berupaya dari segi mental atau bankrap

- Berjawatan Tetap

| PERKARA | BAYARAN MINIMA |

|---|---|

| Yuran | RM60 |

| Syer | RM 200.00 (10 BULAN X RM20) |

| Insurans Berkelompok | RM10.00 |

| Simpanan Khas | (HAD MAKSIMUM ADALAH SEHINGGA 60% POTONGAN GAJI) |

Pinjaman Peribadi Popular

PEMBIAYAAN PERIBADI 3.90% /p.a

- Jumlah maksimum pembiayaan adalah RM 150,000

- Had umur adalah tidak melebihi 54 tahun dan tiada penjamin

- Memerlukan sekurang-kurangnya 2 Penjamin untuk mereka yang berumur 54 tahun ke atas

- Kelayakan maksimum tidak melebihi dari 60% daripada pendapatan bulanan

- Kadar keuntungan adalah 3.9% setahun

- Tempoh bayaran balik pembiayaan selama 120 Bulan

PEMBIAYAAN KREDIT 3.50% /p.a

- Jumlah maksimum pembiayaan adalah RM 150,000

- Kelayakan maksimum tidak melebihi dari 60% daripada pendapatan bulanan

- Kadar keuntungan adalah 3.5% setahun

- Tempoh bayaran balik pembiayaan selama 120 Bulan

- Pembiayaan ini boleh digunakan untuk membeli pelbagai barangan seperti kereta, peralatan elektrik dan juga pengubahsuaian rumah

PEMBIAYAAN AKTIVITI PERNIAGAAN 3.50% /p.a

- Jumlah maksimum pembiayaan adalah RM 30,000

- Kelayakan maksimum tidak melebihi dari 60% daripada pendapatan bulanan

- Kadar keuntungan adalah 3.5% setahun

- Tempoh bayaran balik pembiayaan selama 120 Bulan

PEMBIAYAAN PELBAGAI 3.90% /p.a

- Pembiayaan ini disediakan bagi membaharui Insurans Am, cukai jalan, peralatan kenderaan dan lain-lain perkhidmatan yang disediakan koperasi

- Jumlah maksimum pembiayaan adalah RM 5,000

- Kelayakan maksimum tidak melebihi dari 60% daripada pendapatan bulanan

- Kadar keuntungan adalah 3.9% setahun

Perkhidmatan

Kebajikan

Derma Pelajaran Anak

Kelayakan memohon

- Menjadi anggota Koperasi Anggota Kerajaan Ipoh Berhad tidak kurang dari 3 tahun.

- Anak Kandung Anggota.

- Anak Tiri atau Anak Angkat anggota yang sah disisi Undang-Undang (Berdaftar).

- Keputusan peperiksaan UPSR, PT3, SPM/SPVM, STAM, STPM, Matrikulasi atau yang setaraf.

Permohonan yang lengkap hendaklah sampai kepada KAKIB sebelum 31 Julai setiap tahun

Khairat Kematian

Kadar bayaran dan kelayakan

- RM 1500.00 atas kematian anggota KAKIB. Dibayar kepada waris yang sah

- RM 1000.00 atas kematian suami/isteri anggota

- RM 500.00 atas kematian ibu/bapa anggota

- RM 500.00 atas kematian anak berumur diantara 2 minggu hingga 18 tahun

Tuntutan boleh dibuat dalam tempoh 3 bulan dari tarikh kematian dengan mengemukakan dokumen yang lengkap kepada KAKIB .

Dividen Tahunan

KAKIB memberikan dividen tahunan yang tinggi kepada anggota seperti berikut:-

- DIVIDEN 2019 = 7.1%

- DIVIDEN SIMPANAN KHAS 2019= 8%

Pajak Gadai Islam Ar Rahnu

Ar- Rahnu Kakib merupakan subsidiari milik penuh koperasi Anggota Kerajaan Ipoh Berhad (KAKIB) yang menjalankan pajak gadai Islam. Ar Rahnu ini menawarkan pinjaman tunai segera yang bercagarkan barangan kemas sahaja.

| KELAYAKAN | Warganegara Malaysia 18 Tahun ke atas |

|---|---|

| UPAH SIMPAN | RM0.80 untuk setiap nilai |

| NILAI SIMPANAN | Maksima sehingga RM 25000 untuk setiap transaksi |

| MARGIN PEMBIAYAAN | Sehingga 80% daripada nilai marhun |

| TEMPOH GADAIAN | Selama 6 bulan dan boleh diperbaharui |

| JENIS BARANGAN KEMAS | Emas yang bermutu 18K sehingga 24K |

Pelancongan

KAKIB SAFAR TRAVEL & TOURS (KSTT) merupakan subsidiari dan telah dirasmikan pada 4 Disember 2018 oleh Encik Mohd Hizaz Bin Mohd Ibrahim, Pengarah Kementerian Pelancongan, Seni dan Budaya Malaysia Negeri Perak. KSTT menyediakan pakej umrah dan pelancongan luar dan dalam negara pada harga berpatutan. Selain itu harga istimewa juga turut diberikan kepada anggota-anggota KAKIB.

KAKIB juga turut menyediakan pembiayaan khas bagi pakej umrah dan pelancongan yang ditawarkan oleh KSTT untuk kemudahan para anggota. Para anggota yang berminat boleh menghubungi nombor dibawah:

Tel: 05-5252998 / 016-4216471 FB: KAKIBSAFARTRAVEL

“KAMI REALISASIKAN IMPIAN ANDA”

https://www.kakib.my

#pinjamanperibadi #KoperasiServices #KAKIB #koperasi

Hubungi KAKIB

- Tel: 05-2540707 / 05-2535369

- KOPERASI ANGGOTA KERAJAAN IPOH BERHAD

NO. 111-B, TINGKAT 1 JALAN DATO’ ONN JAAFAR

30300 IPOH PERAK - Opening Hours: 8am-5.30pm (Monday-Friday)

Topik Terhangat & Trending

Nak tahu cara urus pinjaman dengan lebih bijak? Kami kongsikan info penting tentang pinjaman bank, koperasi, dan cara urus wang dengan lebih mudah. Klik untuk teruskan membaca dan mula ubah cara anda berbelanja.

-

Terbaru! Koperasi Tentera KT (KATMB): Pinjaman Ekspres

Koperasi Tentera KT (KATMB) Pinjaman peribadi Koperasi Tentera KT (KATMB) ditujukan kepada anggota tentera Angkatan Tentera Malaysia (ATM) dengan interest rendah dan tempoh pinjaman panjang.…

-

Koperasi Kesatuan Guru-Guru Melayu Malaysia Barat (KGMMB): Lubuk Pembiayaan Hebat

Koperasi Kesatuan Guru-Guru Melayu Malaysia Barat Berhad (KGMMB) Koperasi Kesatuan Guru-Guru Melayu Malaysia Barat Berhad atau lebih dikenali sebagai KGMMB telah ditubuhkan pada tahun 1974…

-

Koperasi Belia Islam Malaysia (KBI): Kuasakan Pinjaman Peribadi Anda

Koperasi Belia Islam Malaysia Berhad (KBI) Koperasi Belia Islam Malaysia Berhad (KBI) terus melangkah ke hadapan dengan tawaran pembiayaan Islamik dan pinjaman peribadi yang fleksibel…

-

Koperasi Kakitangan Bank Simpanan Nasional (KOBANAS): Dapatkan Sekarang!

Koperasi Kakitangan Bank Simpanan Nasional Berhad (KOBANAS) Koperasi Kakitangan Bank Simpanan Nasional Berhad (KOBANAS) adalah koperasi terbaik yang menawarkan banyak perkhidmatan pembiayaan kepada anggotanya. Dapatkan…

-

Koperasi Jabatan Penjara Malaysia (KOPEN): Pelbagai Pembiayaan Terbaik

Koperasi Jabatan Penjara Malaysia Berhad (KOPEN) Koperasi Jabatan Penjara Malaysia Berhad (KOPEN) menawarkan pelbagai pembiayaan kepada anggota koperasi seperti pinjaman peribadi bai al-inah, pembiayaan pengguna…

-

Koperasi Telekom Malaysia Berhad (KOTAMAS): Pembiayaan Terbaik

Koperasi Telekom Malaysia Berhad (KOTAMAS) Koperasi Telekom Malaysia Berhad (KOTAMAS) menyediakan perkhidmatan pinjaman peribadi koperasi terbaik dan lain-lain produk. Sila dapatkan cara memohon disini. Pengenalan…

-

Koperasi Kakitangan Kementerian Pertanian Malaysia Berhad (KOTANI)

Koperasi Kakitangan Kementerian Pertanian Malaysia Berhad (KOTANI) Koperasi Kakitangan Kementerian Pertanian Malaysia Berhad KOTANI menjalankan promosi pinjaman peribadi dan perkhidmatan koperasi lain. Dapatkan ianya sekarang!…