Bank Muamalat

Looking for a reliable personal loan in Malaysia? Bank Muamalat offers competitive financing tailored for government employees, military personnel, and retirees. With flexible terms and trusted service, it’s a smart choice for your financial needs. Apply now or explore your options today.

Introduction

Anti- Bribery & Corruption Statement

Bank Muamalat Malaysia Berhad (“BMMB”) and its subsidiaries are committed to conducting business with transparency, integrity and compliance with regulatory requirements as well as good corporate governance practices.

In line with this commitment, the Bank adopts a ‘zero tolerance’ approach against all forms of bribery and corruption. All members of the Board of Directors, staff and third parties must uphold the highest standard of integrity and accountability in discharging their duties.

The principles of BMMB’s Anti-Bribery and Corruption Policy state:

Bribery

All forms of bribery and corruption in relation to BMMB’s activities are prohibited.

No Gift Policy

The Bank has adopted a “No Gift” policy. It is prohibited to offer or receive any gift that may influence good judgment and decision making.

Entertainment

All employees and directors are allowed to provide or accept entertainment to/from third parties only if for legitimate business purposes.

Donation & Sponsorship

Sponsorship and Donation must be transparent and not used as a subterfuge for bribery.

Product & Services

Muamalat Invest

Muamalat Invest Sdn Bhd (“MISB”) is a wholly-owned subsidiary of Bank Muamalat Malaysia Berhad. Muamalat Invest, a licensed Islamic fund manager, has been a licensed fund management company since 2006, and was accorded the Islamic Fund Management license in September 2010.

Wakaf Muamalat

Economic prosperity through Wakaf

Since 2012, Wakaf Muamalat has been active to empower wakaf through various collaborations and synergies for broader outreach. To date, Wakaf Muamalat has collected more than RM 26.7 million. Through Wakaf Muamalat, the needy and underprivileged will be in good hands.

Explore wakaf opportunities with us!

Jariah Fund

Jariah Fund is an online crowdfunding platform which aims to assist the underprivileged and contribute to society. The platform eases the donation drive through its transparent features by providing current reports and updates of the amount collected and the state of the intended beneficiaries.

Popular Personal Loans

Structured Personal Financing-i

- Minimum Financing : 2 years

- Maximum Financing : 10 Years

- Financing Up to RM250,000*

- Age up to 70 years old*

- No Guarantor Required

- No Processing Fee

- No Hidden Charges

- Debt Consolidations

- *subject to terms and conditions

Pesara (3P) 5.50%/p.a

- Tenure Minimum: 3 years Maximum: 10 years

- Financing Amount Minimum: RM 5,000.00 Maximum: RM 250,000.00

- Profit Rate Competitive Flat & Floating Rate

- Mode of Payment Pension with BMMB

- Wasiat/Will – writing Optional (highly encourage)

- Takaful Optional (highly encourage)

i Programme

- Minimum Financing : 2 years

- Maximum Financing : 10 Years

- Financing Up to RM250,000*

- Age up to 70 years old*

- No Guarantor Required

- No Processing Fee

- No Hidden Charges

- Debt Consolidations

- *subject to terms and conditions

Cash-i $485/p.a

- Age 18 and above

- Financing up to 60 years old or up to retirement age (whichever is earlier)

- Malaysian citizen

- Government Employees Federal and State Governments Confirmed position or is a permanent staff Minimum Income (salary + fixed allowance) of RM3,000 and above

- Newly Employed Civil Servant (NECS) Minimum Income of RM2,000 Employment less than 1 year

- Government, GLCs, GLICs & Employers under Empanelment Program

Repayment Table

PESARA TENTERA & KAKITANGAN KERAJAAN 5:50% (TETAP)

| JUMLAH PEMBIAYAAN (RM) | 1 TAHUN | 2 TAHUN | 3 TAHUN | 4 TAHUN | 5 TAHUN | 6 TAHUN | 7 TAHUN | 8 TAHUN | 9 TAHUN | 10 TAHUN |

|---|---|---|---|---|---|---|---|---|---|---|

| 10,000 | 879 | 463 | 324 | 254 | 213 | 185 | 165 | 150 | 138 | 129 |

| 20,000 | 1,758 | 925 | 647 | 508 | 425 | 369 | 330 | 300 | 277 | 258 |

| 30,000 | 2,638 | 1,388 | 971 | 763 | 638 | 554 | 495 | 450 | 415 | 388 |

| 40,000 | 3,517 | 1,850 | 1,294 | 1,017 | 850 | 739 | 660 | 600 | 554 | 517 |

| 50,000 | 4,396 | 2,313 | 1,618 | 1,271 | 1,063 | 924 | 824 | 750 | 692 | 646 |

| 60,000 | 5,275 | 2,775 | 1,942 | 1,525 | 1,275 | 1,108 | 989 | 900 | 831 | 775 |

| 70,000 | 6,154 | 3,238 | 2,265 | 1,779 | 1,488 | 1,293 | 1,154 | 1,050 | 969 | 904 |

| 80,000 | 7,033 | 3,700 | 2,589 | 2,033 | 1,700 | 1,478 | 1,319 | 1,200 | 1,107 | 1,033 |

| 90,000 | 7,913 | 4,163 | 2,913 | 2,288 | 1,913 | 1,663 | 1,484 | 1,350 | 1,246 | 1,163 |

| 100,000 | 8,792 | 4,625 | 3,236 | 2,542 | 2,125 | 1,847 | 1,649 | 1,500 | 1,384 | 1,292 |

| 110,000 | 9,671 | 5,088 | 3,560 | 2,796 | 2,338 | 2,032 | 1,814 | 1,650 | 1,523 | 1,421 |

| 120,000 | 10,550 | 5,550 | 3,883 | 3,050 | 2,550 | 2,217 | 1,979 | 1,800 | 1,661 | 1,550 |

| 130,000 | 11,429 | 6,013 | 4,207 | 3,304 | 2,763 | 2,401 | 2,143 | 1,950 | 1,800 | 1,679 |

| 140,000 | 12,308 | 6,475 | 4,531 | 3,558 | 2,975 | 2,586 | 2,308 | 2,210 | 1,938 | 1,808 |

| 150,000 | 13,188 | 6,938 | 4,854 | 3,813 | 3,188 | 2,771 | 2,473 | 2,250 | 2,076 | 1,938 |

| 160,000 | 14,067 | 7,400 | 5,178 | 4,067 | 3,400 | 2,956 | 2,638 | 2,400 | 2,215 | 2,067 |

| 170,000 | 14,946 | 7,863 | 5,501 | 4,321 | 3,613 | 3,140 | 2,803 | 2,550 | 2,353 | 2,196 |

| 180,000 | 15,825 | 8,325 | 5,825 | 4,575 | 3,825 | 3,325 | 2,968 | 2,700 | 2,492 | 2,325 |

| 190,000 | 16,704 | 8,788 | 6,149 | 4,829 | 4,038 | 3,510 | 3,133 | 2,850 | 2,630 | 2,454 |

| 200,000 | 17,583 | 9,250 | 6,472 | 5,083 | 4,250 | 3,694 | 3,298 | 3,000 | 2,769 | 2,583 |

| 210,000 | 18,463 | 9,713 | 6,796 | 5,338 | 4,463 | 3,879 | 3,463 | 3,150 | 2,907 | 2,713 |

| 220,000 | 19,342 | 10,175 | 7,119 | 5,592 | 4,675 | 4,064 | 3,627 | 3,300 | 3,045 | 2,842 |

| 230,000 | 20,221 | 10,638 | 7,443 | 5,846 | 4,888 | 4,249 | 3,792 | 3,450 | 3,184 | 2,971 |

| 240,000 | 21,100 | 11,100 | 7,767 | 6,100 | 5,100 | 4,433 | 3,957 | 3,600 | 3,322 | 3,100 |

| 250,000 | 21,979 | 11,563 | 8,090 | 6,354 | 5,313 | 4,618 | 4,122 | 3,750 | 3,461 | 3,229 |

* Sebarang perubahan pembayaran balik pembiayaan tertakluk kepada terma & syarat.

For Armed Forces

Tawaran menarik bagi pinjaman peribadi Bank Muamalat Malaysia Berhad (BMMB) seperti berikut:

Bank Muamalat Personal Financing-i For Armed Forces

| Loan Details | Investment & Refinancing for Armed Forces |

|---|---|

| Purpose | Settlement of Debt and Investment |

| Who Can Apply | Malaysia Armed Forces |

| Tenure | Minimum: 3 years, Maximum: 10 years* |

| Financing Amount |

Minimum: RM5,000.00 Maximum: RM100,000.00 |

| Profit Rate |

Flat: 5.5% p.a Floating: BFR + 1.8% (capped at 11%) |

| Mode of Payment | Auto debit from net salary via BMMB Current/Saving Account |

| Will Writing (Wasiat) | Optional |

| Takaful | Compulsory |

| Guarantor | Not required |

| Documents Required |

• Copy of BATC10/MyTentera (front and back) • Latest 1-month salary slip (Flat Rate) • Latest 2-month original salary slips (Floating Rate) • BMMB Current/Saving Account passbook • Latest settlement statement • Investment statement (if applicable) |

| Applicant’s Eligibility |

• LLP (Other Ranks): Maximum age 52 years • Officers: Maximum age 65 years |

Government & Related Agencies Staff

Bank Muamalat Financing products:

| Loan Details | PPK Financial Management Financing – Investment & Refinancing (Civilian) |

|---|---|

| Purpose | Settlement of debt and investment |

| Who Can Apply | Federal / State Government staff, Government-linked companies, and selected organizations |

| Tenure | Minimum: 3 years, Maximum: 10 years |

| Financing Amount | Minimum: RM5,000.00 Maximum: RM100,000.00 |

| Profit Rate |

Flat Rate: – Without Ju’alah: 5.5% p.a – With Ju’alah: 5.7% p.a Floating Rate: BFR + 1.8% (capped at 11%) |

| Mode of Payment |

a) Auto debit from net salary via BMMB Current/Saving Account b) Salary deduction at source by employer |

| Will Writing (Wasiat) | Optional |

| Takaful | Compulsory |

| Guarantor | Not required |

| Documents Required |

• Copy of NRIC (front and back) • Latest 1-month salary slip (Flat Rate) • Latest 3-month original salary slips (Floating Rate) • Employment confirmation letter • Latest settlement statement • Investment statement (if applicable) |

| Applicant’s Eligibility |

• Employment: – Non-Government: Permanent & confirmed staff with minimum 3 years of service – Government: Confirmed staff • Repayment capacity determined by NDI & DSR |

Note:

- Customer’s not a Bankruptcy during apply Bank Muamalat Malaysia Berhad BMMB financing

- Terms and conditions apply

Selected Organizations Staff

| Loan Feature | Investment & Refinancing (Civilian – Selected Organization) |

|---|---|

| Purpose | Settlement of debt and investment |

| Who Can Apply | Staff from selected organizations |

| Tenure | Minimum: 3 years Maximum: 10 years |

| Financing Amount |

Minimum: RM5,000.00 Maximum: RM150,000.00 (Floating Rate) Maximum: RM100,000.00 (Flat Rate) |

| Profit Rate |

Flat Rate: – Without Ju’alah: 5.5% p.a – With Ju’alah: 5.7% p.a Floating Rate: BFR + 1.8% (capped at 11%) |

| Mode of Payment |

a) Auto debit from net salary via BMMB Current/Saving Account b) Salary deduction at source by employer |

| Will Writing (Wasiat) | Compulsory |

| Takaful | Compulsory |

| Guarantor | Not required |

| Documents Required |

• Copy of NRIC (front and back) • Latest 1-month salary slip (Flat Rate) • Latest 3-month original salary slips (Floating Rate) • Employment confirmation letter • Settlement statement • Investment statement (if applicable) |

Note:

- Customer’s not a Bankruptcy during apply Bank Muamalat Malaysia Berhad BMMB financing

- Terms and conditions apply

2.45% Interest Rate

Among the advantages that you can enjoy if you apply for low interest personal financing as follows:

- Competitive profit rates from 2.45%

- Fast approval process of 3-5 working days.

- The maximum amount of financing is RM400,000.

- Flexy financing period 2-10 years.

- Fresh loan is allowed.

- Applicants with blacklisted records CCRIS CTOS are encourage to apply.

Annual 3.69% (Blacklisted)/p.a

- Max financing RM400K

- Loan tenure 2-10 years

- CCRIS CTOS is eligible. Bank will settle your blacklist

- Basic salary RM3,000

- Minimum document needed

- Auto debit or pay slip salary deduction

*Source from Bank Muamalat Malaysia Berhad website

#personalloan #Bank #BankMuamalat

Takaful and Shariah Concepts

Bank Muamalat Personal Financing-i (Tawarruq) is a financing facility that is designed to provide cash financing to the customers for personal consumption/ use which does not contravene with the Shariah principles.

Generally, this product is based on Tawarruq as its underlying Shariah concept for provision of financing.

The financing structure under the Tawarruq arrangement involves the combination of Wa’d Mulzim, Murabahah, Wakalah and Bai’ Wadhi’ah contracts.

Tawarruq consists of two sale and purchase contracts where the first involves the sale of an asset by a seller to a purchaser on a deferred basis. Subsequently, the purchaser of the first sale will sell the same asset to a third party on a cash basis.

Murabahah refers to a sale and purchase of an asset where the acquisition cost and the mark-up are disclosed to the purchaser.

Wakalah means a contract in which a party (muwakkil) authorises another party as his agents (wakil) to perform a particular task, in matters that may be delegated, either voluntarily or with imposition of fee.

Wa’d refers to an expression of commitment given by one party to another to perform certain action(s) in the future.

Bai’ Wadhi’ah is a sale contract whereby the asset / commodity is sold at lower price than the cost incurred by the Customer.

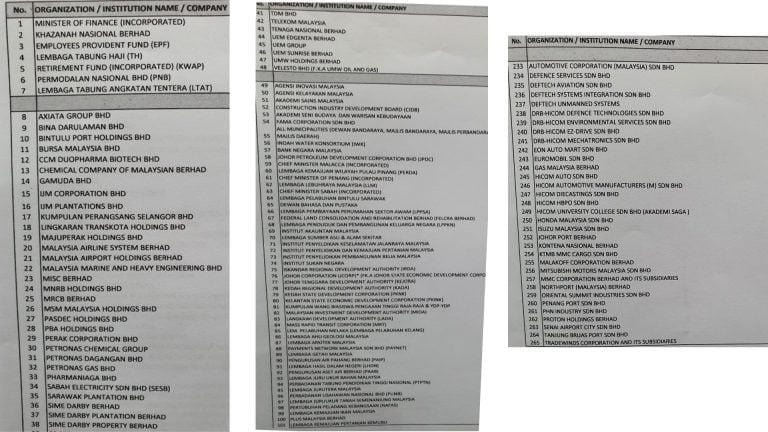

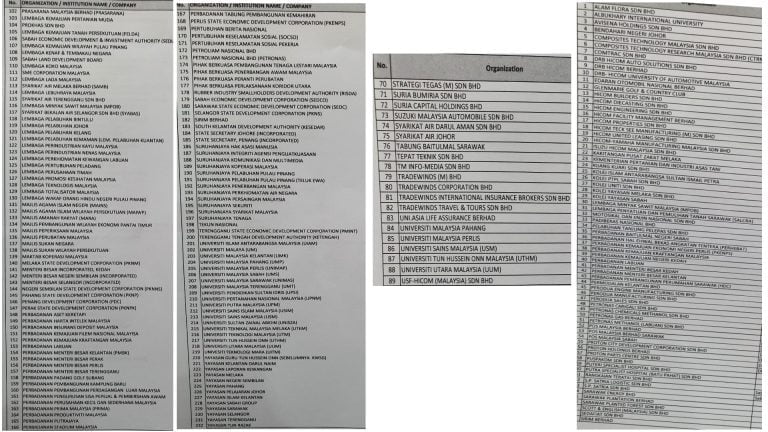

Company Panel List

The following is the list of eligible Bank Muamalat panel companies. It includes more than 500 organizations, comprising government agencies, selected statutory bodies, and approved private companies. Please find the full panel list below.

Government

- Ministry of Finance (Incorporated)

- Khazanah Nasional Berhad

- Employees Provident Fund (KWSP)

- Lembaga Tabung Haji (TH)

- Kumpulan Wang Amanah Pencen (KWAP)

- Permodalan Nasional Berhad (PNB)

- Lembaga Tabung Angkatan Tentera (LTAT)

- Agensi Inovasi Malaysia

- Agensi Kelayakan Malaysia

- Akademi Sains Malaysia

- Fama Corporation Sdn Bhd

- Indah Water Konsortium

- Bank Negara Malaysia (BNM)

- Lembaga Kemajuan Wilayan Pulau Pinang (PERDA)

- Chief Minister of Penang (Incorporated)

- Lembaga Lebuhraya Malaysia (LLM)

- Felcra Berhad

- Perbadanan Kemajuan Kraftangan Malaysia

- Permodalan Kelantan Berhad

- Perbadanan Menteri Besar Kedah

- Perbadanan Menteri Besar kelantan

- Perbadanan Baitulmal Negeri Sabah

- SIRIM Berhad

- Universiti Malaysia Pahang

- Universiti Utara Malaysia (UUM)

- Universiti Malaysia Perlis

- Universiti Sains Malaysia (USM)

- Suruhanjaya Koperasi Malaysia

- Suruhanjaya Koperasi dan Multimedia Malaysia

- Suruhanjaya Syarikat Malaysia (SSM)

- Suruhanjaya Sekuriti

- Tekun Nasional

- Suruhanjaya Hak Asasi Manusia

- Suruhanjaya Persaingan Malaysia

Company & GLC

- Axiata Group Berhad

- Bina Darulaman Berhad

- Bintulu Port Holdings Bhd

- Bursa Malaysia Berhad (BSKL Kamariah dah Resign)

- Gamuda Berhad

- IJM Corporation Berhad

- Malaysia Airline System Berhad

- MISC Berhad

- Petronas Dagangan Berhad

- Petronas Gas Bhd

- Petronas Chemical Bhd

- Petronas Chemical Group

- Pharmaniaga Berhad

- MRCB Berhad

- Sime Darby Berhad

- Sime Darby Plantation Berhad

- Sime Darby Property Berhad

- SP Setia Berhad

- Takaful Malaysia

- Perodua Engine Manufacturing Sdn Bhd

- Perodua Manufacturing Sdn Bhd

- Perodua Sales Sdn Bhd

- Puspakom Sdn Bhd

- Putri Specialist Hospital Sdn Bhd

- Padiberas Nasional Berhad

- Pelabuhan Tanjung Pelepas Sdn Bhd

- Sabah Port Sdn Bhd

- Glenmarie Gold and Country Club

- Edaran Otomobil Nasional Berhad

- Kijang Kuari Sdn Bhd

- Sedafiat Sdn Bhd

- Rangkaian Teratai Sdn Bhd

- Lembaga Pertubuhan Peladang (LPP)

- Lembaga Totalisator Malaysia

- Majlis Agama Islam Negeri (MAINS)

- Lembaga Perusahaan Timah

- Majlis Agama Islam Wilayah Persekutuan (MAIWP)

- Melaka State Development Corporation

- Pahang State Development Corporation

- Penang State Development Corporation

- Perak State Development Corporation

- Perbadanan Putrajaya

- Perbadanan Stadium Malaysia

Company & GLC

- Telekom Malaysia

- Tenaga Nasional Berhad (TNB)

- UEM Group

- UEM Sunrise Berhad

- UEM Holdings Berhad

- Velesto Berhad (formerly known as UMW Oil and Gas)

- DRB Hicom and all its subsidiaries

- Malakoff Corporation Berhad

- Kontena Nasional Berhad

- Mitsubishi Motor Malaysia Sdn Bhd

- MMC Corporation Berhad and its subsidiaries

- Penang Port Sdn Bhd

- Proton Holding Berhad

- Senai Airport City Sdn Bhd

- Tanjung Bruas Port Sdn Bhd

- Tradewinds Corporation and its subsidiaries

- Kolej Yayasan Melaka Sdn Bhd

- Syarikat Air Johor (SAJ)

- Uni.Asia Life Insurance Berhad

- USF-HICOM (Malaysia) Sdn Bhd

For full list, please click pictures below:

Contact Bank Muamalat

Location and Address

Banks in Malaysia

Bank Muamalat Malaysia Berhad

Ibu Pejabat, Menara Bumiputra,

21 Jalan Melaka,

50100 Kuala Lumpur

Call Center

+603-2600 5500

Hot & Trending Topic

Looking to take control of your loans and spend smarter? We’ve got you covered with practical tips on handling bank loans, co-op financing, and managing your money with ease.

Ready to make better financial choices? Tap here to start your journey toward smarter spending.

-

Alliance Bank Personal Financing – 3.99% p.a. Online Exclusive Offer

Alliance Bank Looking for affordable personal financing? Alliance Bank offers a limited-time online exclusive rate of just 3.99% p.a. with minimal fees and fast approval.…

-

Bank Islam (BIMB) – Shariah-Compliant Financing for Government & Business Needs

Bank Islam Malaysia Berhad (BIMB) Bank Islam Malaysia Berhad (BIMB) offerings Personal Financing Loan for permanent and contract for Government and Business Loan. Find out…

-

AgroBank Cash-i Personal Financing – Your Trusted Choice for Government & GLC Staff

AgroBank Looking for a reliable and Shariah-compliant personal financing solution? AgroBank Cash-i offers up to RM200,000 in financing exclusively for government employees and selected GLC…

-

OCBC Bank Personal Loan: Flexible Monthly Payments

OCBC Bank Looking for the best personal loan in Malaysia? OCBC Bank offers Shariah-compliant financing, competitive interest rates, and flexible monthly payments—perfect for your financial…

-

Bank Simpanan Nasional (BSN): Personal Loan up to RM200,000

{ “@context”: “https://schema.org”, “@type”: “WebPage”, “mainEntityOfPage”: { “@type”: “WebPage”, “@id”: “https://koperasi.business/bsn/” }, “name”: “Bank Simpanan Nasional (BSN) Personal Financing”, “url”: “https://koperasi.business/bsn/”, “inLanguage”: “en”, “keywords”: […

-

HSBC Personal Financing – Up to RM250,000 Shariah Compliant

HSBC Looking for a trusted Islamic financing solution? HSBC Amanah offers up to RM250,000 in Shariah-compliant personal financing for existing, premier, and new customers. Whether…